Protect Your Business with Positive Pay

The 2024 AFP® Payments Fraud and Control Survey Report, released last month by the Association for Financial Professionals, revealed that 80% of the over 500 surveyed organizations were victims of payment fraud attacks and/or attempts in 2023, up from 65% in 2022. Checks were the main target (65%), followed by ACH debits (33%). With the surge in mail theft-related check fraud, criminals are using increasingly sophisticated methods to “wash” or alter payees and amounts on stolen checks. Left undetected, check fraud can significantly impact your business. Fortunately, Positive Pay can help protect your business and provide peace of mind.

What is Positive Pay?

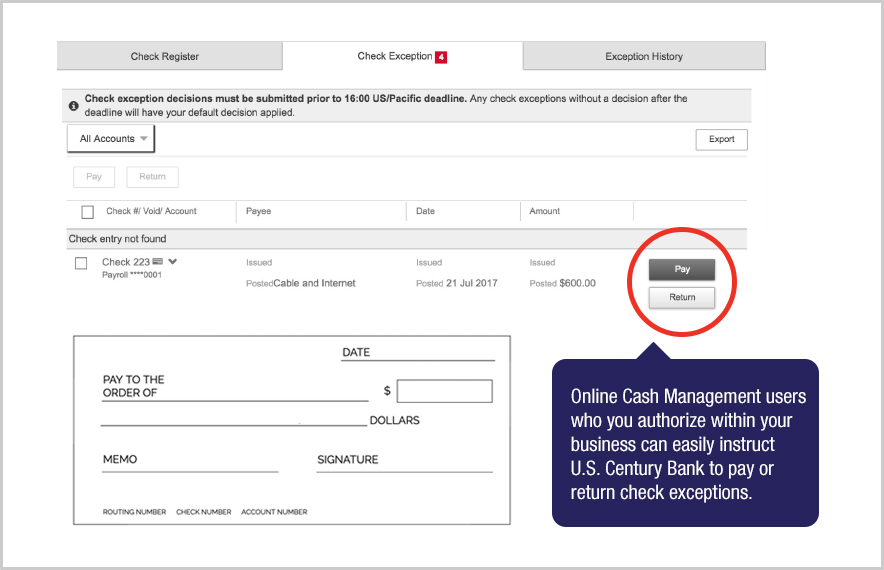

Positive Pay is an automated fraud prevention service within U.S. Century Bank’s online cash management suite that helps detect and prevent check fraud. It works by matching the details of checks presented for payment against a list of checks your company has authorized and issued. Any discrepancies – or exceptions – are flagged and brought to your attention for review, reducing the risk of fraudulent checks being cashed against your business account.

How does Positive Pay work?

The process begins when your business issues and distributes checks to your vendors and suppliers. The check information, including the date, check number, and amount, is entered into the online cash management check register. When a check is presented for payment, the bank's system matches the check information against what was previously entered by your company. If there is a match, the check is paid as usual. However, if there is an exception, such as a different check amount, the check is flagged for review.

Who can benefit from using Positive Pay?

Positive Pay benefits any business that regularly issues and receives a high volume of checks. However, small businesses, in particular, can benefit greatly from this service. As a small business owner, you are likely involved in all aspects of your company, including financial management. Therefore, the added layer of security provided by Positive Pay can ease some of the financial burdens and allow you to focus on other areas of your business.

When would Positive Pay be useful for a small business?

Imagine you own a small retail store, and you write checks to five of your suppliers for new inventory purchases. You add the issued checks manually into your U.S. Century Bank online cash management check register. (Hint: you may also upload a file with all your issued checks quickly and easily). The following week, you receive an account notification email from U.S. Century Bank advising you have a check exception. Because you have Positive Pay, the system detected that the check received for payment from your largest supplier does not match the information in your register. The check has been altered.

For example:

- Check date is missing based upon matching check number

- Check number is a duplicate of one that has already been processed

- Check amount does not match the issued amount

- Check date is missing based upon matching check number

- Check number is a duplicate of one that has already been processed

- Check amount does not match the issued amount

You immediately log in to online cash management and select “Return” as your instruction to U.S. Century Bank. Thanks to Positive Pay, you avoided paying a fraudulent check and suffering a financial loss. This scenario highlights the valuable protection that Positive Pay offers to small businesses against check fraud.

Our Services

As a customer of U.S. Century Bank, you will have access to our robust and secure Treasury Management Services including Positive Pay. We provide secure check fraud prevention solutions tailored to your business needs, giving you peace of mind and protecting your business from financial losses.

In addition to Positive Pay, we offer other services that can help streamline your business's financial management, such as ACH Positive Pay and Remote Deposit Capture. Our goal is to provide you with the tools and support you need to focus on growing your business while we take care of your financial needs.

Contact us today to learn more about how our Positive Pay service can benefit your business.